Another round of colleges v kegs

“Prohibition is better than no liquor at all,” argued Will Rogers, Oklahoma's most famous cowboy. Clever minds in his home state are now hoping another ban on booze will bring better results. Starting this week, alcohol is outlawed from campus at the University of Oklahoma (OU).

The university's president, David Boren, a former Democratic senator, has forbidden fraternities and dorms from having alcohol on the premises (sororities are already dry). Even students who are 21 years old, and thus legally allowed to drink in the state, are now flowed to booze only at organized Friday and Saturday night events. Anyone caught violating this policy three times, on or off campus, will be suspended under a new "three-strikes" rule.

One in three American colleges bans alcohol, according to a recent study by researchers at Harvard's School of Public Health. Dry campuses abound in the South and the mid-west. For the most part, these are small places-though the teetotallers include the University of Kansas and, unsurprisingly, the University of Utah.

As anyone will know who has read-Tom Wolfe's latest novel, "I am Charlotte Simmons", or merely followed the antics of the Bush twins; American universities plainly have a drink problem, OU's crackdown came because a freshman died after a raucous fraternity pledge-night last September. If research is to be believed, two in five students "binge drink" and as many as 1,400 die each year of alcohol-related causes, mostly drunk driving.

But will banning alcohol from campus work? It could well merely push drinking into surrounding streets, from which students will have to stumble (or drive) home. A 2001 Harvard study • found that fewer students on dry campuses drink, but those who do imbibe just as much as their counterparts at "wet" places.

Universities are fighting the demon in other ways. Alcohol-awareness programmes are ubiquitous, and more parents are being notified if their kids are caught at the keg. Some universities have toyed with adding more Friday classes, though teachers do not like these. Others are running late-night coffee-houses as alternative entertainment. Pushed partly by insurance costs, more fraternities are joining sororities in going dry. And diehard drinkers could always choose to study abroad: in Britain, not only are you I allowed to drink at 18, but student unions are actually allowed to sell the stuff I themselves, on campus.

Text 10

Big Mac's makeover

OAK BROOK, ILLINOIS

The world's biggest fast-food company has pulled off a remarkable comeback

In the entrance to Hamburger University, the ultramodern training centre for the world's biggest fast-food operation, Ray Kroc's office has been faithfully reassembled. McDonald's managers have looked to their late founder quite a bit lately for inspiration in how to deal with a series of crises, any one of which would have destroyed many companies. Mr Kroc used to say he didn't know what McDonald's would sell in the future, except that the company would sell the most of whatever it was. Remarkably, McDonald's has turned itself into the world's biggest seller of salads and its business is flourishing again. Yet despite all of its new lettuce, free-range eggs, bottled water and yoghurt parfaits, success remains, at least for now, all about burgers.

The company reached a low point in 2001, when customer-satisfaction surveys showed McDonald's was falling well behind its direct rivals, Wendy's and Burger King. Customers were also switching to healthier offerings, such as Subway's freshly filled sandwiches. Lots of money was spent opening yet more stores, but margins were shrinking and complaints about dirty restaurants and indifferent staff were growing. The firm's philosophy of QSC&V-quality, service, cleanliness and value – just was not working any more. McDonald's ended 2002 with its first quarterly loss since 1954, the year Mr Kroc persuaded the McDonald brothers to let him franchise their new "Speedee" self-service restaurant system.

McDonald's had lost more than direction. A wave of anti-American feeling abroad turned its world famous "golden arches" from an asset into a liability. And there was growing concern about obesity and junk food. McDonald's was even sued (so far, unsuccessfully) for making people fat. Even now, long after its debut in America, Morgan Spurlock's film "Super Size Me" is making overseas audiences cringe at how he made himself ill and gained 25 pounds (11kg) by eating only McDonald's food for 30 days.

Many companies might have tried to muddle through. But in January 2003, Jim Cantalupo, a McDonald's veteran who used to head international operations and who had been passed over for the top job, was brought back from retirement to replace Jack Greenberg, forced out as chief executive by worried shareholders. The "Plan to Win", as the company's recovery strategy is called, is largely Mr Cantalupo's work. He was hugely popular at the firm's headquarters in a leafy Chicago suburb.

However, in April, while attending a McDonald's convention in Florida, Mr Cantalupo, who was 60, died after a heart attack. A lot of businesses would have been thrown into chaos by the loss of their leader at such a time. But McDonald's swiftly executed a succession strategy already in place. Within hours, Charlie Bell, a 43-year-old Australian promoted by Mr Cantalupo to chief operating officer, was addressing the troops as the first non-American to head the company. Yet the health scares remain. Mr Bell was diagnosed with cancer in May. Even while recovering from treatment, he has been determined to remain at the helm.

Fat, dumb, not happy

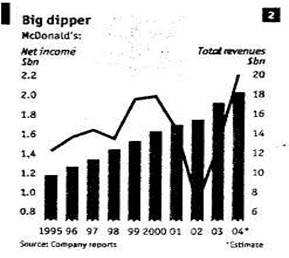

Mr Bell, who joined the company as a 15-year-old restaurant worker (a "crew member", as McDonald's calls them), is characteristically blunt about what went wrong. There are a lot of companies, he says, that "get fat, dumb and happy and take their eye off the ball." People thought McDonald's was no longer capable of impressive results, he says. Yet for the first half of this year sales were up 13% to $9.1 billion, and net profits rose 38% to $1.1 billion, compared with the same period a year earlier. On October 13th McDonald's announced stunning third-quarter preliminary results. Its earnings per share jumped by 42% and sales again grew strongly. Much of McDonald's growth, though, has come from America: Europe has not yet shown a decisive turn for the better.

Measured by sales, McDonald's is about twice as big as its next global competitor, Yum! Brands, operator of Kentucky Fried Chicken (kfc), Pizza Hut and Taco Bell (although McDonald's operates slightly fewer restaurants). McDonald's makes its money from its 9,000 company-owned restaurants and the rent and service fees paid by franchisees and licence holders, who operate a further 22,000. A study by Citigroup Smith Barney reckons the average franchisee expects annual sales of about $1.7m from a restaurant and an operating profit of almost 5150,000. This, it believes, could grow now that McDonald's is concentrating on expanding sales in existing restaurants.

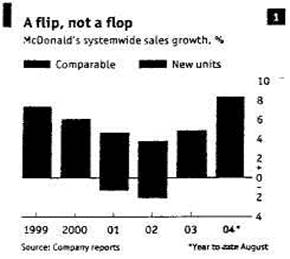

Instead of opening lots of new restaurants. McDonald's has switched to generating more sales from its existing ones. This year, some 90% of McDonald's growth is likely to come from incremental sales at its existing restaurants, compared with around half last year (see chart 1). Last year, its restaurants worldwide generated an additional $4oom to take annual positive cash flow to $3.3 billion. In September, McDonald's said it would use its cash pile to boost its annual dividend for the second consecutive year, pay down $600m-700m in debt and spend up to $1.6 billion opening some new restaurants (often in places like China), but mostly in doing up its existing ones.

Text 11

Bаck to basics

Cleaner, smarter restaurants will help, but it is notoriously difficult to impose and then reinforce standardized operating procedures through a highly decentralized business-part of the problem when standards were falling. New technology will make things easier. Every McDonald's has a "travel path" along which a member of staff must walk-sometimes every 30 minutes – to ensure that all is well. The company is now testing small hand-held devices, which can be used like electronic clip-boards by those making the rounds. Failures to check, say, the temperature inside a refrigerator (the devices are fitted with a probe) or to scan a location barcode (they have a scanner too) when checking the play area, will be recorded. If too many incomplete checks build up, the device can automatically alert the local manager by ringing his mobile phone.

This might sound Big Brotherish, but McDonald's insists that its businesses will remain, in effect, lots of local restaurants, although ones expected to operate within clearly denned parameters. That still allows for plenty of variation. In some Latin American cities, McDonald's is even experimenting with differential pricing: charging different prices for meals according to the relative wealth of their neighbourhoods. "If you are looking for a command centre with one push button mat operates our restaurants in every corner of the world, you won’t find it," says Jim Skinner. McDonald's vice-chairman.

And like any local restaurant, it is what is on the menu that is really important. The average sale in a McDonald's is just under $5. Typically what might happen is a mother comes in, buys her children a Happy Meal, and herself just a coffee. Now that salads and other lighter options have been added to the menu, many of those mothers now buy themselves a meal too, lifting the order value to around $12. The lighter options also encourage existing customers to come back more often because there is a greater variety of things to eat. Nevertheless, for now, the Big Mac remains the most popular item worldwide. McDonald's does not publicly break down sales and profits of its individual items. But anything that involves fresh, perishable produce that does not come in a standardized and easily storable form (ie, a lettuce compared with a frozen hamburger patty), increases complexity and cost. McDonald's officials insist their salads are priced to be profitable, arguing that if they were not its franchisees would not want to sell them. But then, by some measures, supermarket loss-leaders are also profitable because they bring in customers who buy other products. Nevertheless, salads are sending a message to millions of customers: that it is now acceptable to eat at McDonald's again because the menu is "healthier" – even though the vast majority still order a burger and fries.

"There is no question that we make more money from selling hamburgers and cheeseburgers," says Matthew Paull, McDonald's chief financial officer. Sales growth is, he says, being driven by the "halo effect" of healthier food appearing on the menu. He expects that will continue. Beyond 2005 he reckons sales will grow 3-5% a year, and the return on the company's investments in new and remodeled restaurants to be in the "high teens". There will also be more new items appearing on the menu.

What's cooking?

The future of fast food is being cooked-up in an anonymous warehouse sitting among many others on a vast distribution park on the plains of Illinois. This is McDonald's Innovation Centre. Inside are several fully functioning restaurants. As staff prepare and cook meals, others act as customers. Any one of the more than 31,000 McDonald's can be replicated here. Despite the common perception that they are clones, there are plenty of differences-especially on a regional level. The fruit servings that McDonald's is starting to offer its customers illustrate this: there are packets of skinned apple-slices for the Americans, but the skins are left on for Europeans. The Australians, meanwhile, just get an apple. Local tastes and preferences, says a chief, count for a lot.

At a busy replica of a British restaurant, video cameras record a time-and-motion study. Moving the relish dispensers could mean a crew member in the food preparation area no longer has to make a half turn. That could save a second or so, which means a customer gets his burger faster. But will it cause problems elsewhere in the system? Nobody, as Mr Kroc used to say, takes hamburgers more seriously.

Yet the really interesting thing going on here is at a hybrid restaurant, which in part uses McDonald's Japanese system-creator of the Teriyaki burger – and a new concept from Sweden, which grills burgers vertically instead of horizontally as on a traditional griddle. This new type of grill offers great space-saving possibilities-extremely useful in crowded Japan. But it is what is on the menu that, for McDonald's at least, is truly revolutionary.

Among half-a-dozen choices are a "New York Reuben", a "Grilled Veggie" and a "Leaning Tower Italian". As in any experimental facility, McDonald's stresses that not all the ideas being worked on here will make it to market. But the signs are that McDonald's is getting serious about sandwiches. Their experimental "Oven Selects" range, freshly made and toasted to order, is now going on trial at some 400 restaurants in America. If the sandwiches, which will sell for $4 each (relatively expensive for McDonald's), are a hit, they could become a global product.

Moving into the sandwich business means that McDonald's will compete more directly with the likes of chains such as Subway, and against countless corner delis and supermarkets. "Sandwiches our-sell hamburgers by ten to one," says Russ Smyth, president of McDonald's Europe. "So there is a great opportunity here." Ir. order to grow the business in some of its mature markets, McDonald's has to take market share from others. In Europe, says Mr Smyth, the so-called "informal eating-out market" has been declining, but McDonald's has lately managed to boost its share from 11% to 12%.

Sandwiches are not the only innovation in the works. The Australian market pioneered gourmet coffee for its customers. This has been developed into a concept called McCafe, which is already providing coffee lounges inside 500 existing McDonald's restaurants. Some of these are being fitted out as wireless hot spots for the internet. But can McDonald's really hope to take on Starbucks too?

It will be a challenge for the company to manage a multi-format operation under one brand, says Jim Farrell. He has followed McDonald's closely since working there as a teenager and later in his career as a management consultant based in Chicago. Having a bigger variety of items on the menu means more potential problems and higher costs. It also means trying to appeal to one group of customers without alienating another. For instance, says Mr Farrell, a restaurant that is attractive to families and is mil of children clamouring for Happy Meals (or the toys in them) might not appeal to stressed-out office workers who have popped out for a quick sandwich and coffee.

Hot in the kitchen

McDonald's could try to become different things in different locations, and at different times: it is already trying harder to catch the breakfast trade. Mr Farrell suggests another way could be a cluster of operations in which a coffee bar, fast-food outlet and sandwich counter share adjacent parts of the same building – a bit like a rood court.

Yum! Brands already does this by grouping some of its restaurants together to provide an assortment of pizzas, tacos and fried chicken. However it tries to manage this, McDonald's also must watch out for its rivals improving their menus too. Wendy's, for instance, is developing its already successful Tim Hortons brand, which is a North American coffee-shop cum-bakery operation, kfc offers the option of mashed instead of tried potatoes and has started selling chicken with rice.

It remains to be seen just how far McDonald's can expand its menu while keeping its restaurants under the golden arches. As film-maker Mr Spurlock says: "People go to McDonald's to eat burgers." But if more customers start to choose salads or toasted sandwiches, then the balance of the business will change. If that happens, would the McDonald's brand still work? The company has steadily been buying into chains that operate under different brands. Among them is Boston Market, bought in 1999. It operates 630 restaurants in America that boast high-quality "home-style" cooking. In 2001 McDonald's also acquired a minority stake in London – based Pret A Manger, a relatively upmarket coffee, sandwich and salads chain that has done well in Britain and is expanding overseas, with mixed results so far. McDonald's management are guarded about what they intend to do with such investments. But clearly they provide a hedge against the future, just in case existing McDonald's sites needed to be replaced with something radically different.

For now, that is far from necessary. Larry Light, who became global marketing chief in 2002 after running his own brand-building company, quickly trots out ail sorts of figures to show hew awareness of the McDonald's brand, already high, is actually growing. Next to Santa Claus, the most instantly recognized figure in the world by children is Ronald McDonald, the annoying clown who serves as the company's "chief happiness officer". Television ads of his synchronized swimming and high-diving during the McDonald's – sponsored Olympic Games won the company lots of plaudits from the advertising industry this summer.

But Mr Light is doing things differently. "The days of mass-media marketing are over," he says. The three main target groups the company is trying to influence are children, mothers and young adults. Teenagers, for one, are a tough lot to reach now that they spend more time on the internet than watching television. So marketing has to follow them there-or to the music charts by signing up Justin Timberlake and Destiny's Child as part of the company's ad campaign.

The food of love

The McDonald's brand is big, but it means different things to different people. It can also be positioned differently throughout the day, during breakfast, lunch and dinner, if you are eating alone, or with children. Hence the new advertising campaign that Mr Light launched, anchored around the catchy ditty "I'm lovin' it", takes many different forms.

The campaign also has to deal with the most sensitive issue of all: the one portrayed by Mr Spurlock, which has it that eating at McDonald's makes you fat and ill. The company shows no sign of ducking this. The "supersize" portions have been phased out, even though McDonald's maintains that Mr Spurlock was simply acting "irresponsibly" by deliberately consuming so much food and limiting his physical activity.

Such things come with the territory, reckons Mr Bell. He likens it to what Australians call the "tall-poppy syndrome": when you are the tallest in a crowded field, someone will try to cut you down. He agrees that obesity is a genuine problem, but believes his company can help by promoting more active lifestyles and offering more balanced food choices. Is that a marketable proposition? Mr Light, whose job it is to put this message across, thinks so. "If we behave responsibly," he says, "we will be perceived one day not as the problem, but part of the solution."

If McDonald's can pull that off, then it will have achieved a remarkable transformation, as well as having cemented the turnaround in its fortunes. What are its chances? Well, the company is trying pretty hard. In America it has been offering a meal for grownups, promoted by Bob Greene, Oprah Winfrey's personal trainer. It comes with a salad, bottled water, a book of walking tips and a pedometer.

While it is easy to dismiss this as just another sales gimmick, if only a fraction of the 30m pedometers that have already been sold end up being clipped to people's waistbands and succeed in encouraging them to walk a little further, then McDonald's may already have taken one small step toward helping an overweight America to slim down. And that will do its health no harm at all.

Text 12